Neither Norway nor Germany is the Fastest, Türkiye

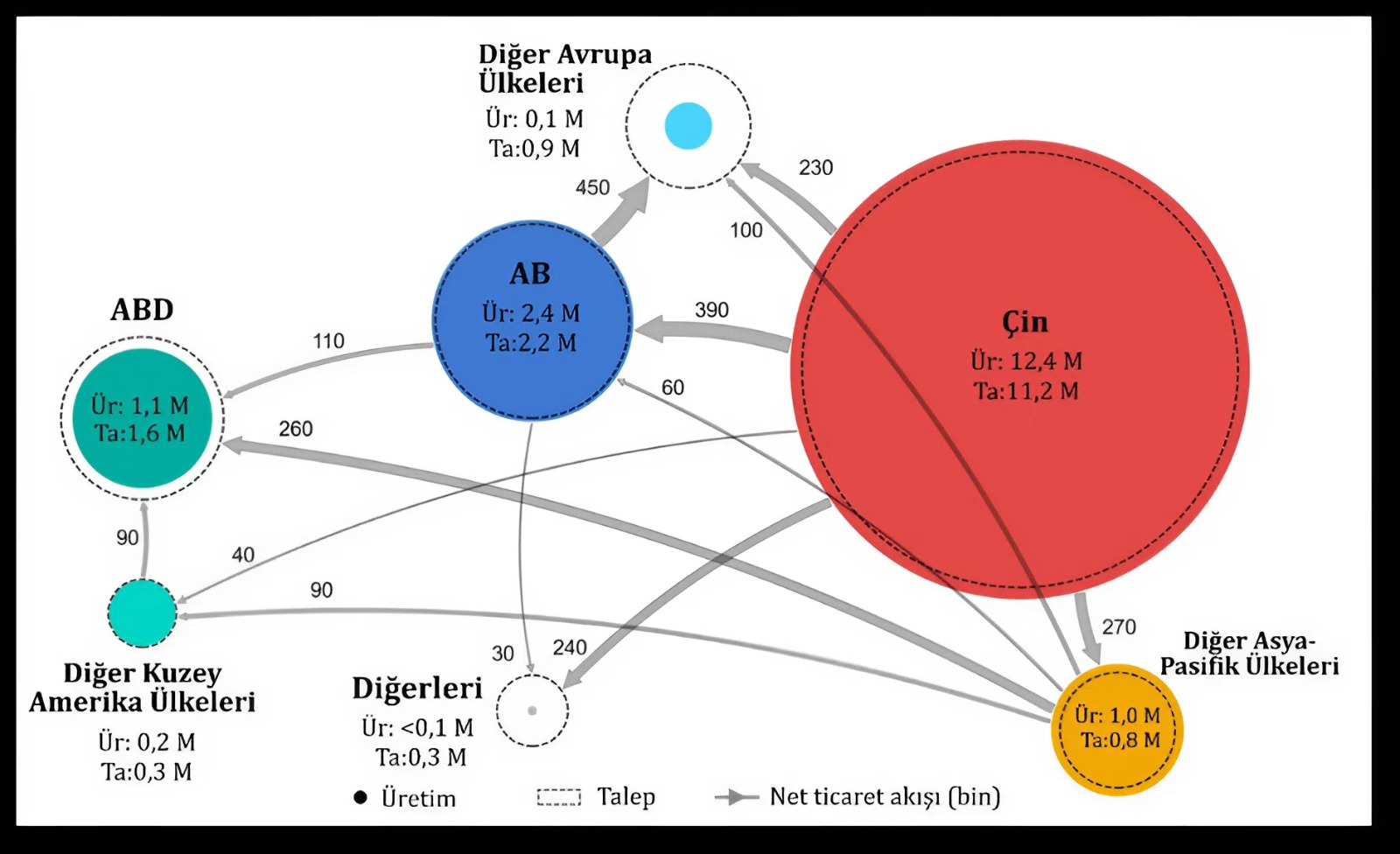

Recently, I've been encountering some striking data regarding both the global and local electric vehicle (EV) markets. The International Energy Agency's (IEA) prediction that over 20 million new EVs will be sold by 2025 demonstrates that this transformation is irreversible. However, the issue isn't just selling vehicles; it's building the infrastructure that will allow those vehicles to "breathe." This is precisely where I see Turkey gaining a strategic advantage.

According to data from the Energy Market Regulatory Authority (EPDK), there will be 35,002 charging stations (sockets) in Turkey as of September 2025. This represents a significant increase of 4.19% compared to the previous month.

Now let's look at Europe's major players: Germany has 50,901 charging stations, France has over 100,000, and the UK has 86,000. At first glance, the numerical superiority of these giants is dazzling. So why am I proud? Because we've focused on quality over quantity.

Of the 35,002 sockets in Turkey , 15,010, or approximately 43%, are DC fast charging points. This rate puts us among the world's best in terms of charging power per vehicle (kW). On long journeys, I believe charging times measured in minutes should be preferred to slow charging that takes hours. Our DC charging rate is double the average of many European countries. So, while our number of stations may be behind them, our average charging speed and quality elevate the user experience.

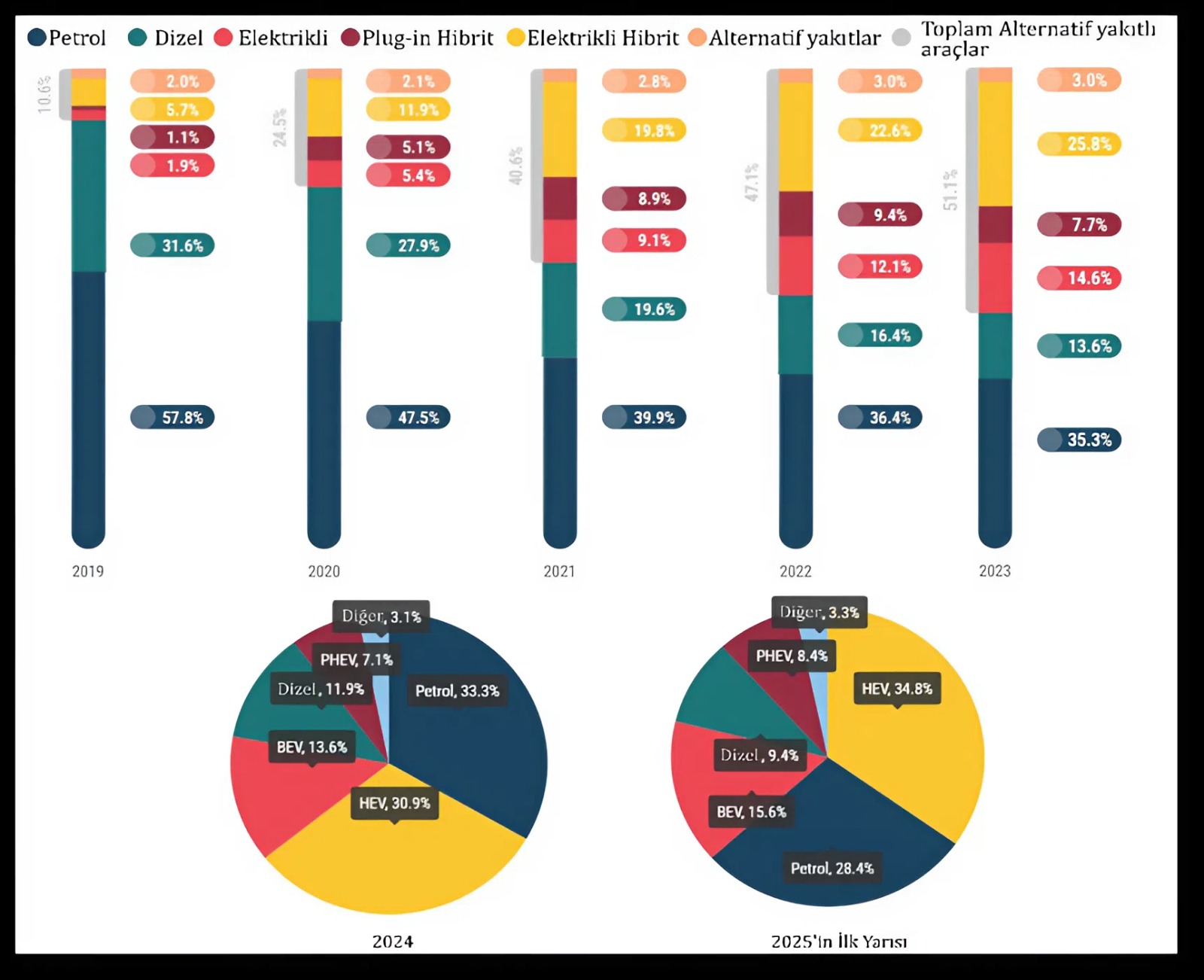

IKV Expert Ahmet Emre Usta's assessment reveals the complex landscape in the European market. According to data from the European Automobile Manufacturers' Association, car purchasing preferences in the EU have undergone a dramatic shift over the last five years:

- Electric Vehicles (BEV): The share jumped from just 1.9% in 2019 to 15.6% in the first half of 2025. However, this rise is fluctuating, including a slight decline (13.6%) in 2024. The end of incentives and the economic slowdown in Europe prove that full stability has not yet been achieved in this market.

- Plug-in Hybrids (PHEV): These also increased from 1.1% in 2019 to 8.4% in the first half of 2025. This rise in the share of hybrids shows that European consumers cannot completely abandon range anxiety and are looking for an intermediate step in the transition to EVs.

This data suggests to me that, despite Europe's high number of charging stations, consumer confidence isn't fully established. They may have more stations, but I'm more likely to find a DC fast charging point in my country. This is a strategic choice for Turkey's EV market and deserves applause.

With the aggressive global EV growth projected by the IEA and our vision for domestic production like TOGG, we must rapidly close the numerical gap in our charging infrastructure. We are leaders in quality, but we must also multiply our numbers to serve millions of new vehicles. This isn't just a matter of electricity, technology, or automotive ; it's a matter of national competitiveness and future vision . I'm confident that this quality step taken by Turkey will take us to a very different level in the global EV revolution. Now it's time to expand this fast and high-quality infrastructure across our entire geography, challenging Europe's numerical superiority. See you in my next column...

Adem Eyüpoğlu \ Timeturk

Timeturk