Key to success: New deal brings Europe one step closer to independence in key raw materials!

Advertisement / Advertising

This signal to the market opens up enormous valuation and growth potential.

-Advertorial | Advertisement-

Dear readers,

Sometimes there is news that acts like a switch: from now on a new valuation level counts.

That's exactly what we're seeing now with Rock Tech Lithium (WKN: A1XF0V) . They announced a strategic partnership with Ronbay Technology , one of the world's largest cathode material manufacturers , a few days ago . This is more than just a handshake— it's entry into the premier league of the European battery industry.

Why this message is so powerful:

? Local & closed supply chain : Rock Tech supplies lithium hydroxide from the converter in Guben directly to Ronbay – the global market leader processes it into cathode materials in Poland. Europe is finally getting its own value chain – independent of Asia.

? Acceptance assured : The MoU is a precursor to long-term contracts. Planning security, cash flows, scaling potential – this brings imagination to the valuation!

? Ronbay = Seal of Quality : Over USD 2 billion in sales, 12-30% global market share for NMC cathodes, production sites in Asia and Europe. That this global player, of all companies, has chosen Rock Tech as its strategic partner is a true honor.

Ronbay's European project marks a crucial step in our global strategy. The partnership with Rock Tech will accelerate the localization of raw material supplies for the project and further strengthen our presence in the European market.

says the head of supply chain at Ronbay .

But as impressive as this deal is, it doesn't stand alone; it's part of a whole series of headlines that show how the global market for battery raw materials is currently intensifying - and how crucial it is to act now.

While Rock Tech and Ronbay are ushering in the development of a European supply chain with their partnership, experts are simultaneously warning of a dramatic imbalance on the global market:

Global power games over lithium: Europe's dependence and the consequences

Fastmarkets forecasts a nearly balanced lithium market in 2025 – with only a surplus of ~10,000 tonnes – and a slight deficit of ~1,500 tonnes could even occur by 2026.

According to the EU Commission, there is a risk of a shortage of battery raw materials (especially lithium and nickel) after 2029/2030 if investments do not increase significantly.

A comprehensive analysis shows that, despite expansion, Europe, the USA and China will only be able to partially cover their demand for lithium through domestic sources by 2030 and will remain heavily dependent on imports.

These are just three recent headlines from the lithium sector that make it clear: urgent action is needed to avoid the bottlenecks as quickly as possible. Converters are considered a bottleneck as long as there is no sufficient refining capacity in Europe – without expansion, real bottlenecks are looming by 2030.

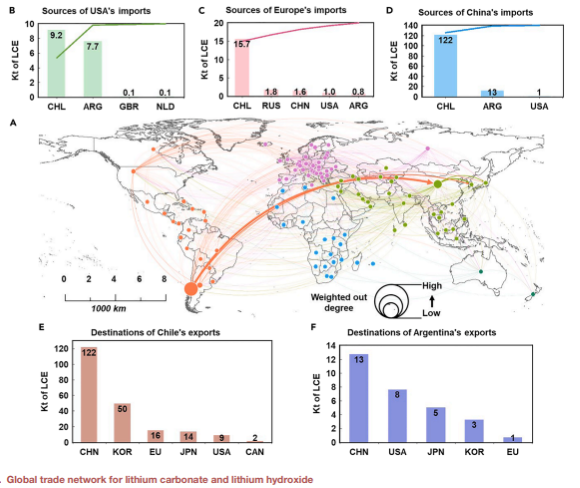

Researchers published the most comprehensive analysis to date of lithium supply and demand in China, Europe, and the United States in Cell Reports Sustainability . Although domestic lithium production in these regions could increase tenfold by 2030, it would not meet the rapidly growing demand for electric vehicles (EVs). China, Europe, and the United States together account for 80% of global EV demand . Forecasts show that China could need up to 1.3 million tons, Europe 792,000 tons, and the United States 692,000 tons of lithium carbonate equivalent . Even with ambitious production plans , domestic production is insufficient : China would need 804,000-1.1 million tons, Europe 325,000 tons, and the United States 229,000-610,000 tons. All three regions would still rely on imports. However, an increase in imports in one region would severely limit availability for others and strain international trade relations.

Global lithium trading market, source: Cell Reports Sustainability

The Achilles heel of electromobility: Europe's race for critical battery materials

While Europe is ambitiously pushing ahead with the transition to electromobility, a recent analysis by the EU Commission reveals a risky game with time. In just a few years, important raw materials such as lithium, nickel, and graphite could become the biggest obstacle to Europe's energy transition. The global market is tight, demand is exploding, and control over the extraction and processing chains lies largely in China.

The figures are alarming: By 2025, the EU's battery demand will reach almost 400 GWh and quadruple by 2040. But Europe's own mines are insufficient to satisfy this hunger. While manganese comes partly from European sources, the Union remains almost entirely dependent on imports for cobalt, nickel, and refined graphite. And these come from politically or logistically risky regions: lithium from Chile and Australia, graphite from Mozambique or China, and cobalt often from the Democratic Republic of Congo – countries that are either unstable or already use their raw materials strategically.

The result: Shortages are already emerging. The EU Commission expects the first supply bottlenecks for lithium and graphite by 2025 at the latest. Without massive investments in new mines, recycling capacities, and innovative battery technologies, an even greater deficit threatens from 2029 onwards. European battery production could then stall—and with it the entire plan to transform mobility and industry into climate-neutral ones.

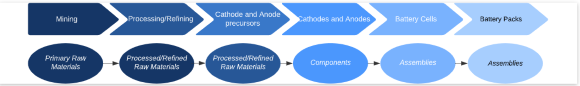

Challenges of the lithium-based battery supply chain, Source: European Commission, RMIS - Raw Materials Information System

But there is hope: The EU is pursuing a two-pronged approach. On the one hand, it aims to reduce its dependence on China through investments in domestic refining and partnerships with stable producing countries such as Canada and Australia. On the other hand, it aims to strengthen the circular economy: Recycling old batteries, longer usage, and second-use concepts could significantly reduce the demand for primary raw materials. The EU Battery Regulation sets ambitious targets in this area, such as binding recycling quotas for lithium, nickel, and cobalt.

Time is running out. Europe's strategic independence in the future market of electromobility is being decided now – between geopolitical tensions, resource-hungry megatrends, and the question of whether recycling and technological innovation are progressing fast enough. Because one thing is clear: Without a secure supply of battery materials, electric cars, power storage, and thus climate goals will remain a risky game of time.

Strong axis at the border: How Rock Tech & Ronbay are securing Europe's e-mobility

Rock Tech Lithium (WKN A1XF0V) and Ronbay Technology – a global leader in cathode materials (CAM) – signed a strategic memorandum of understanding (MoU) yesterday. The goal of the partnership is to jointly establish a fully localized, integrated supply chain for lithium-ion battery materials in Europe.

This strategic partnership sets a clear precedent for Europe's battery future: Rock Tech will supply Ronbay Technology with high-purity lithium hydroxide in the long term – directly from its modern converter in Guben. Together, the partners are building a local, integrated supply chain for key materials for electromobility.

With Rock Tech's location on the German-Polish border and Ronbay's CAM plant in Poland, a cross-border power duo is created that will make a decisive contribution to strengthening European battery production - precisely where Europe is repositioning its energy storage and mobility of the future.

As part of their forward-looking collaboration, Rock Tech Lithium and Ronbay Technology plan to implement several key strategic initiatives that will profoundly strengthen Europe's battery value chain:

Local supply for Europe's battery industry

Rock Tech will supply Ronbay with high-quality lithium hydroxide from its Guben converter, including the newly acquired CAM plant in Konin, Poland. This creates a high-performance European supply chain directly between raw material processing and cathode production.

Know-how transfer for scaling & speed:

Ronbay contributes its decades of engineering and project implementation experience to actively support the construction and commissioning of the Guben converter. At the same time, both partners are exploring opportunities for joint investments in Europe's battery future.

Market access & growth in focus:

In addition, Rock Tech and Ronbay are joining forces in market development – with a focus on European offtake agreements, customer acquisition in the battery and automotive sectors, and the development of strong industrial partnerships along the e-mobility value chain.

This news lays the foundation for a possible revaluation of Rock Tech stock!

Because Ronbay Technology is a global player in the battery materials industry - specializing in high-performance cathode materials for the next generation of lithium-ion batteries - a strong exclamation mark towards the market, politics and industry.

The Chinese manufacturer of cathode active materials (CAM) for lithium-ion batteries was founded in 2014 and has been listed on the STAR Exchange in Shanghai since July 2019. In 2024, the company generated approximately CNY 15.09 billion (approximately USD 2.1 billion at current exchange rates) and employed approximately 4,380 people. Ronbay holds a global market share of over 12-30% in the NMC (nickel manganese cobalt oxide) segment, making it one of the largest suppliers worldwide.

- Advertisement - Conflicts of interest and disclaimer - Advertorial/Advertising [Client: Rock Tech Lithium (WKN: A1XF0V)] -

Rock Tech Lithium (WKN: A1XF0V) is a Canadian-German company specializing in the development and production of high-purity lithium hydroxide for battery cells – from its own raw material mining to regional processing. With its spodumene project near Georgia Lake in Ontario (Canada) and the construction of a lithium converter in Guben (Brandenburg/Germany), Rock Tech is pursuing an ambitious model: a locally sustainable and closed supply chain for electromobility.

Rock Tech Lithium (WKN: A1XF0V) is currently positioning itself as a key player in the green transformation, particularly in the European e-mobility market. With production sites on two continents, strong academic and government partnerships, and a focus on ESG-compliant processes, the company is pursuing a dual strategy of efficiency, innovation, and regional security of supply.

Rock Tech secures top project in Bosnia and Herzegovina

One of the most exciting news for Rock Tech Lithium (WKN: A1XF0V ) is the acquisition of a mining project in Bosnia and Herzegovina, a candidate country for EU membership. This project is one of the most promising lithium deposits in Europe and is of strategic importance to Rock Tech.

The mine is one of Europe's most promising lithium sources and offers sufficient resources to produce approximately 600,000 tons of lithium carbonate – a key building block for battery technology. The area also contains valuable raw materials such as bauxite and magnesium – key materials for the aluminum industry and industrial transformation.

The key advantage is that the project not only supplies lithium raw materials, but can also produce a special lithium product – lithium sulfate!

This product is a key input material for the Guben converter, which can significantly reduce production costs throughout the entire value chain.

The acquisition will be carried out in several phases, beginning with the pre-feasibility study, which will be conducted in collaboration with renowned engineering firms to confirm the mine's feasibility and economic viability. The focus will be on sustainable development according to the highest ESG standards, an important criterion for European investors and customers.

From raw material to return - Rock Tech's door to the European battery industry

This strategic acquisition is an important step to close the entire lithium value chain in Europe and make Rock Tech Lithium (WKN: A1XF0V ) a leading supplier.

Enormous strategic importance of the project:

- Regional value creation: The project strengthens the local lithium supply in Europe and reduces dependence on imports from Asia or South America.

- Cost reduction: The direct on-site production of lithium sulfate saves capital costs and operating costs in the converter in Guben.

- Sustainability: Environmental and social standards are strictly adhered to, which is essential for European partners and investors.

- Independence: Europe is positioning itself as an independent player in the global lithium market.

From around 2030, lithium sulfate will be produced locally and delivered directly to the planned converter in Guben (Germany), where it will be processed into lithium monohydrate (LHM) for EV batteries.

The Guben Converter: Europe's key project for lithium production

Parallel to the mine acquisition in Bosnia and Herzegovina, construction of the Guben converter in Brandenburg is progressing. This project is a key building block for the European lithium industry, as it will process lithium concentrate from various sources into battery-grade lithium sulfate.

The Guben project positions Rock Tech Lithium (WKN: A1XF0V ) as a first-mover in Europe with robust support from government subsidies and strategic partners. With market-ready planning, secure logistics, state-of-the-art technology, and a strong financial foundation, Guben is a central building block of the European battery value chain – ideal for investors committed to the green mobility revolution.

The lithium factory in Guben, Brandenburg, as a model

Source: RockTech Lithium

The Guben converter will be designed to process spodumene concentrates from Australia, Africa, Brazil, Canada, and, in the future, Bosnia-Herzegovina. The plant is thus flexible and future-proof.

The plant is designed to produce enough lithium for approximately 500,000 electric cars per year. A long-term expansion is planned, which, thanks to the company's own lithium sulfate production from the mine in Bosnia, will reduce capital expenditures and operating costs by up to 30% and 50%, respectively.

Details on financing and construction progress

- Project financing: 60% of the costs will be covered by project financing, supported by the European Investment Bank and a strong banking consortium.

- Subsidies: Around 100 million euros in funding from state and federal programs for structural support in coal-producing regions.

- Equity: The majority of equity financing has already been secured, and further partnerships will be finalized in the coming months.

- Construction period: 24 months of construction are planned, with production of the first lithium products starting in the second half of 2027.

Knighthood: First European funding after recognition as a "Strategic Project"

The news is quite significant: Rock Tech Lithium (WKN: A1XF0V ) has been recognized as a eligible project partner in EIT RawMaterials' high-profile KAVA program - a significant validation step for the company's technological and strategic relevance in the EU raw materials sector.

With innovation funding of 800,000 euros, the company is strengthening its technological leadership position at the Guben site – a clear vote of confidence in the company's strategic role for Europe's battery industry.

"We are very pleased to have been selected for the KAVA funding and the opportunity to work with our partners to bring innovative and potentially groundbreaking lithium processing technologies to market."

Mirco Wojnarowicz, CEO Rock Tech Lithium

A few days ago, the company set another milestone in its global innovation strategy:

Rock?Tech Lithium secured CAD 388,074 in funding from the Critical Minerals Innovation Fund

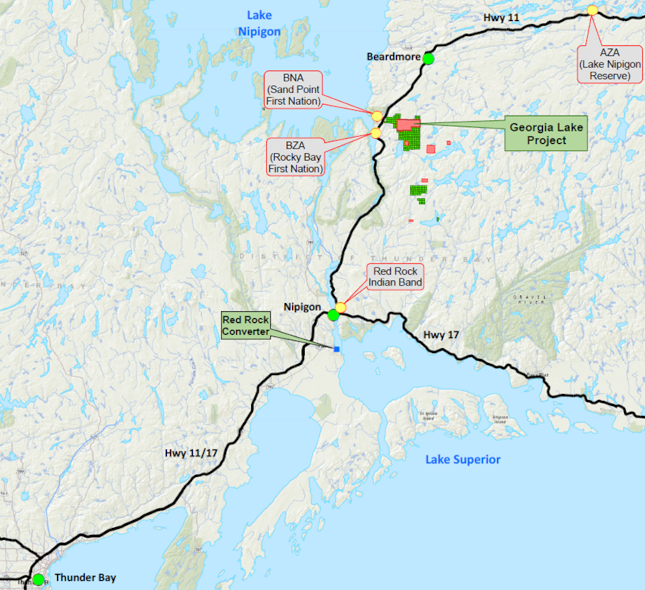

These funds will be used to develop a highly innovative sorting technology for low-grade spodumene ores at the Georgia Lake Project , with the aim of increasing lithium recovery from previously uneconomic ore reserves to an impressive 80%.

Source: RockTech Lithium

The funded project aims to develop and test an energy-efficient sorting process that will enable a lithium yield of up to 80% from low-grade spodumene ores (0.3-0.5% Li2O) that were previously considered uneconomical . Rock?Tech is thus addressing a key problem facing the industry: the economic exploitation of previously neglected deposits. The goal is to significantly improve the economic viability and ecological efficiency of lithium production in Canada – and thus make an important contribution to the province of Ontario's critical raw materials strategy and the transformation to a sustainable energy supply .

?? Growth spurt in North America: The Red Rock Converter

Rock Tech Lithium (WKN A1XF0V) is now bringing its successful model from Europe directly to the Canadian deposit: Ontario's first lithium converter is being built on the site of the former Norampac Paper Mill in Red Rock, just 60 km from its own Georgia Lake Spodumene Project.

Rock Tech has already secured a regionally anchored long-term partner in the BMI Group: BMI is investing CAD 5.5 million – partly as an equity investment and partly as a long-term loan – and providing a 20-hectare site on a leasehold basis. The joint venture aims to develop Red Rock into a multimodal logistics hub for critical minerals on Lake Superior.

The Red Rock Converter is the second value-added asset alongside Guben and strengthens Rock Tech's profile as an integrated lithium refiner on two continents. Early partnerships and government funding programs reduce financing risk, while proximity to the mine and future North American OEM gigafactory increases margin potential. For long-term investors, the project thus offers an additional catalyst for valuation and growth – precisely where the North American battery industry is emerging.

Enormous strategic leverage

- Short transport routes: Ore from Georgia Lake reaches the refinery directly by road and rail – lower costs & CO2 footprint.

- First-mover advantage: As a pioneering facility in Ontario, the converter benefits from political backing for the province's Critical Minerals Corridor initiative.

- Technology transfer: Up to 80% of the engineering know-how from the Guben converter can be transferred - time and cost advantages.

The converter fits seamlessly into Canada's "Critical Minerals Corridor" – a policy designed to promote domestic battery metals. Rock Tech is thus positioning itself as a first mover in a market where OEM gigafactories are just emerging.

Why Rock Tech Lithium is now a "must-have" in your portfolio:

The recently announced strategic partnership between Rock Tech Lithium and Ronbay Technology , one of the world's leading manufacturers of cathode materials, marks a game changer for Rock Tech's positioning in the European battery industry .

This collaboration combines two key value chain stages – lithium refining and cathode production – into an integrated, locally anchored supply chain in the heart of Europe. Rock Tech thus fulfills several key criteria that should now make investors sit up and take notice:

Three strong reasons to get started:

- Secure offtake - secure prospects: The partnership secures Rock Tech long-term sales channels for the lithium hydroxide from the Guben converter - a decisive step towards sales and planning security.

- Part of a key European industry: Amid geopolitical uncertainty, demand for local supply chains is growing. Rock Tech is now part of an industrial policy-supported network that actively reduces Europe's dependence on Asian raw material structures.

- Increased valuation likely: Joining forces with a global market leader like Ronbay is a sign of confidence with a signal effect – both for institutional investors and strategic partners. A revaluation of the stock seems more than justified.

With this partnership, Rock Tech joins the league of strategically relevant players in the European battery market. For investors focused on growth, innovation, and independence in e-mobility , the stock is now more than ever a clear buy candidate with future potential .

We wish you good luck with your investment decisions – with best regards from the editorial team of Mining Investor.

Information pursuant to Section 34b (1) of the German Securities Trading Act (WpHG) in conjunction with FinAnV (Germany)

Disclaimer

This promotional article was created by employees of Orange Unicorn Ltd. on June 26, 2025, and modified on July 1, 2025. Pursuant to Section 84 of the German Securities Trading Act (WpHG), the activities of Orange Unicorn LTD. have been reported to BaFin. This is a paid advertisement; please note the information in accordance with Section 34b (1) of the German Securities Trading Act (WpHG) in conjunction with the FinAnV (German Financial Markets Regulation). Payment is made exclusively by the advertising company and not by third parties.

All publications, including reports, presentations, announcements, and articles ("Publications") are for informational purposes only and do not constitute a recommendation to buy or sell securities. These Publications are not to be equated with professional financial analysis, but merely reflect the opinion of Orange Unicorn/mining-investor.com ("Publisher") or the authors of the Publications working for them ("Authors"). Every investment in the financial instruments presented here, such as stocks, bonds, derivatives on securities, etc. (collectively, "Financial Instruments"), is associated with opportunities, but also with risks, including total loss. Buy/sell orders should always be limited for your own protection. This applies in particular to the small- and micro-cap stocks discussed here, which are suitable exclusively for speculative and risk-conscious investors.

Each investor acts at their own risk. We provide solely marketing and advertising services and are not involved in the company's management or business decisions. The publisher and its authors assume no liability for the timeliness, accuracy, completeness, or other quality of the publications.

Information pursuant to Section 34b (1) of the German Securities Trading Act (WpHG) in conjunction with FinAnV (Germany)

The mediators, authors, and publishers were compensated by Rock Tech Lithium for reporting on the company. This clearly and specifically constitutes a conflict of interest.

Individual disclosures regarding securities holdings of the publisher and authors and/or remuneration of the publisher or authors by third parties associated with publications will be expressly disclosed in or below the respective publication.

Unless otherwise stated, the prices/rates for the financial instruments discussed in the respective publications are the closing prices of the previous trading day or more recent prices prior to the respective publication. General Disclaimer: These publications are for informational purposes only. All information and data in the publications originate from sources that the publisher or author considers reliable and trustworthy at the time of preparation. The publisher and authors have taken the greatest possible care to ensure that the data and facts used and underlying them are complete and accurate, and that the assessments and forecasts drawn upon are realistic.

However, the publisher assumes no liability for the accuracy, completeness, and timeliness of the information contained in the publications.

The publisher has no obligation to update.

Please note that subsequent changes to the information contained in the publications and the opinions expressed therein by the publisher or author may occur. In the event of such subsequent changes, the publisher is not obligated to communicate or publish them. The statements and opinions of the publisher or author do not constitute a recommendation to buy or sell a financial instrument. The publisher is not responsible for any consequences, especially for losses, that may result from the use of the information and opinions contained in the publications.

In particular, the publisher and authors do not guarantee that profits can be made or that specific price targets can be achieved as a result of the purchase of financial instruments that are the subject of publications.

The publisher and author are not professional investment advisors. The publisher and author act for third parties in connection with publications. They receive compensation from third parties for publications, which may lead to a conflict of interest, which is hereby expressly stated.

The information and opinions of third parties presented on the publisher's website, particularly in chats, do not reflect the opinion of the publisher, who therefore assumes no liability for the timeliness, accuracy, completeness, or quality of the information. The copyrights of the individual articles remain with the respective authors. Reprinting and/or commercial distribution, as well as inclusion in commercial databases, are permitted only with the express permission of the respective author or publisher.

copyright

The copyrights of the individual articles are held by the publisher. Reprinting and/or commercial distribution, as well as inclusion in commercial databases, are permitted only with the express permission of the publisher. Use of the publications is permitted for private purposes only. Professional use is subject to a fee and only permitted with the prior written consent of the publisher. Publications may not be transmitted, directly or indirectly, to the United Kingdom, the United States, or Canada, or to US citizens or persons residing in the United States, Canada, or the United Kingdom.

Imprint:

Information according to § 5 TMG:

Orange Unicorn Ltd

132-134 Great Ancoats Street

M4 6DE Manchester

Contact:

Telephone: +44 (0)161 768 0646

Email: info [at] mining-investor.com

Register court: England and Wales

Registration number: 15974038

Supervisory authority: Companies House

Included values: CA77273P2017,CNE100003MS6

Disclaimer: The articles offered here are for information purposes only and do not constitute buy or sell recommendations. They are neither explicitly nor implicitly to be understood as a guarantee of a specific price development for the financial instruments mentioned, nor as a call to action. The purchase of securities entails risks that can lead to the total loss of the invested capital. This information does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either expressly or implicitly, for the timeliness, accuracy, appropriateness, and completeness of the information provided, nor for financial losses. ABC New Media has no influence whatsoever on the published content and had no knowledge of its content and subject matter prior to publication. The publication of named articles is carried out independently by authors such as guest commentators, news agencies, and companies. Consequently, the content of the articles cannot be determined by the investment interests of ABC New Media and/or its employees or bodies. The guest commentators, news agencies, and companies are not part of the ABC New Media editorial team. Their opinions do not necessarily reflect the opinions and views of ABC New Media and its employees. ( Extensive disclaimer )

nachrichten-aktien-europa